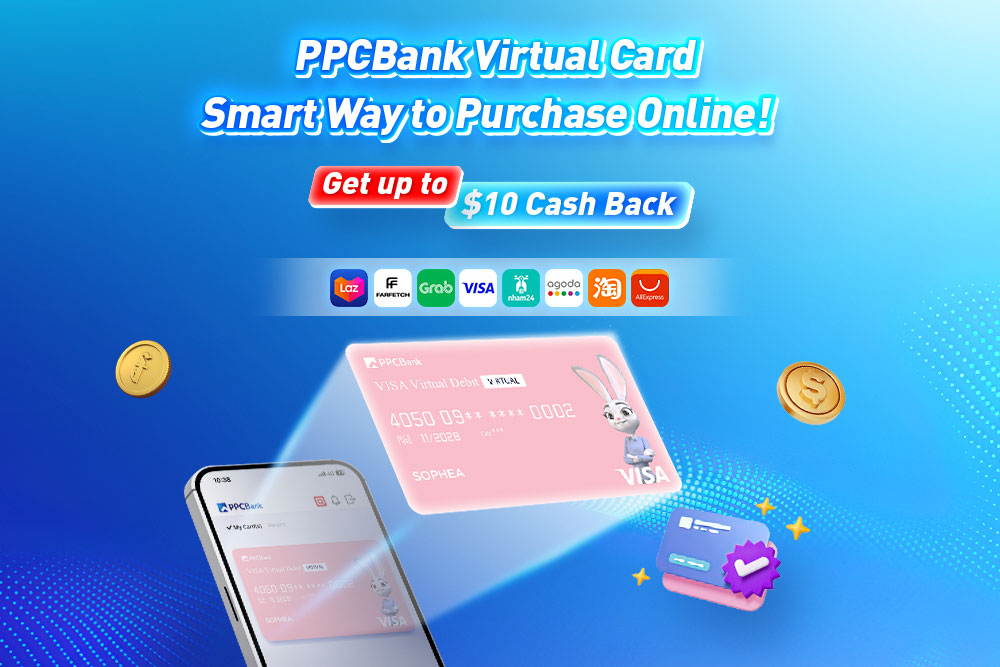

Phnom Penh, December 1, 2023 – PPCBank, one of Cambodia’s leading commercial banks, today unveiled its new Virtual Card to provide more security and convenience for customers shopping and making payments online. The Virtual Card is free of charge and can be created by customers themselves on PPCBank Mobile App. It is a completely separate digital payment card and has its own card number, CVV and expiration date.

PPCBank Virtual Card Enables Hassle – Free Online Payments

The Virtual Card will be welcome news for customers who don’t like to use their existing Visa Card when online. The new cards are created instantly on PPCBank Mobile App and can be loaded with up to $10,000. Once they’ve been created, the Virtual Card can be used online immediately, securely and easily. They have all the bells and whistles of a physical payment card, but only exist digitally.

PPCBank President, Mr. LEE Jin Young, said today’s launch of the PPCBank Virtual Card was in line with the Bank’s commitment to making banking as easy and convenient as possible. “There’s one thing our customers can never get enough of – time. So we’re really focusing on developing innovations that reduce paper work, remove clunky processes and make the lives of business-owners and private customers even easier,” he said. “PPCBank Mobile App users can now easily create their PPCBank Virtual Card and make online payments, in addition to having access to multiple benefits and exciting promotions,” he added.

Apart from instant issuance, those benefits include no annual fees, 3D Secure for safe online shopping, 10% cashback (capped at $10) for every dollar spent, increased monitoring of expenses and the elimination of credit checks. The PPCBank Virtual Card can be used online around the world, wherever Visa is accepted.

Virtual Cards are becoming increasingly popular amidst a rise in online card fraud. The PPCBank Virtual Card allows cardholders to take control of their security, enabling them to easily block the card as and when required. They can even issue single-use card numbers to help protect their online transactions. The advanced, smart card security features of the new PPCBank Virtual Card ensure spending is controlled before the card is used, and not after. This means cards can even be issued for a specific purpose, with the spending pre-approved and any unauthorized expenditure blocked.

Once customers have created their PPCBank Virtual Card in the “Card” function of PPCBank Mobile App, they can quickly and easily activate the card, linking it to any of their existing Savings and Current accounts.

Download PPCBank Mobile App now https://ppcbank.com.kh/app/